Aligned with our investment thesis, we’ve scored some of the investment deals we know about in 2018, to give you our top 10 to watch in 2019. We reviewed 213 seed-financings this year in Ontario. Each deal has been graded in 3 areas (rounded to the nearest whole number while the score weighs each area as 1/3 of the total and combines the fractions with a score of 100 being best):

- Founding Team (size and experience of founding team, experience in great companies, experience with previous startups, diverse team)

(5 is best) - Financial Backing and Buzz (strength of the investor and their past track record, size of the investment, and investment buzz)

(8 is best) - Market Size and Product Category (estimate of their Canadian and World Wide market size, category analysis, competitive or channel forces)

(5 is best)

The top 10 most interesting start-up financings this year, and the companies to watch for in 2019:

| Rank | Start-Up | Score | Team | Backing | Opportunity |

| 1 | DarwinAI | 96 | 5 | 7 | 4 |

| 2 | SkyWatch | 93 | 4 | 8 | 4 |

| 3 | Zoom.ai | 90 | 4 | 7 | 4 |

| 4 | Green Tank Technologies | 90 | 5 | 5 | 4 |

| 5 | Acerta | 88 | 5 | 7 | 3 |

| 6 | Avro | 87 | 4 | 8 | 3 |

| 7 | Jiffy | 87 | 5 | 6 | 3 |

| 8 | Cinchy | 86 | 5 | 6 | 3 |

| 9 | Hostaway | 83 | 5 | 6 | 3 |

| 10 | NorthOne | 82 | 5 | 6 | 3 |

DarwinAI, Skywatch, Acerta, and Avro are from K-W, while the rest are from Toronto.

The Profiles:

| DarwinAI is the next evolution in A.I. development. Based on distinguished scholarship by an award-winning team led by a Canada Research Chair in A.I., DarwinAI takes the guesswork out of building better A.I.

Through our patented Generative Synthesis™ A.I.-building A.I., DarwinAI enables A.I. to work in the real world by making deep learning faster, portable, scalable, and understandable. Making A.I. work for anyone, anywhere, anytime. |

| SkyWatch provides a digital infrastructure for the distribution of Earth observation data and derived intelligence providing application developers with a single access point to the world’s best Earth observation data and advanced processing algorithms.

SkyWatch EarthCache is a cloud-based platform with comprehensive APIs to facilitate machine-to-machine integration, informative dashboards to monitor usage, and an easy-to-use code builder to rapidly develop associated applications. Adopting EarthCache into your development environment eliminates the need for multiple integration points, legal contracts, pricing and payment models, and costly multi-point searches. Instead, EarthCache allows the development teams to focus on the business application and in delivering actionable intelligence to the end-user. |

| Productivity is wasted as employees juggle time-consuming admin tasks between priority work. Zoom.ai is a chat-based productivity tool that helps employees to offload and automate everyday tasks including searching for files, scheduling meetings, generating documents and much more. Get back to your higher value work by using Zoom.ai — all within your favourite chat platform. |

| A global leader in vaporizing hardware and product design, they are committed to shaping the industry by developing innovative technologies. At Green Tank Technologies, they know that producers and extractors spend years and tons of money developing their quality bud and oil. They set out on a mission to provide quality devices that deliver full flavor and the ultimate user experience. Green Tank designs, develops, and produces industry leading quality vaporization hardware with True-Taste Ceramic Core Technology for full flavor and maximum terpene profiles. |

| Acerta provides a platform that uses machine learning and AI to detect malfunctions and predict failures in real-time for vehicles and their systems (eg. engines, transmission, pumps, motors, etc.). Acerta is a unique platform in that it is able to leverage the data from across the vehicle lifecycle, starting from development and testing, to manufacturing and on-road driving. We are thus ensuring quality throughout the vehicle life.

We have started making an impact for manufacturers today by applying our platform and analysis during assembly. In our most recent deployment we were able to reduce warranties by 30% by identifying complex patterns in testing data that were indicative of defects. We also saved the engineers from having to inspect 4,000 plots per failure – our models automatically identified just 10 that engineers used for troubleshooting. Our recent projects with autonomous vehicle manufacturers are also already bearing fruits! We are introducing important safety features for braking and steering, as well as passenger comfort features. |

| Avro Life Science is developing skin patches for generic drug delivery, focusing on therapeutics for children and the elderly. The core of our technology is a novel biopolymer which is used as a platform for passive transdermal drug delivery of small molecules and drugs. |

| Jiffy is an online platform that connects homeowners with home service providers in real time, based on proximity and availability. These professionals are all pre-vetted. |

| Cinchy is the leading provider of enterprise data collaboration technology, the revolutionary alternative to data sharing. |

| Hostaway is an easy-to-use channel manager for vacation rental hosts that want to increase their client base. It uses existing listings and creates new ones for all the sales channels the host wants to use. |

| Our purpose is to make you and your business more successful by bringing business banking into the 21st century.

We’re building Canada’s first mobile-first API-based banking platform that helps startups and small businesses bank, manage their finances, and integrate all of their financial tools in a simple and intuitive way. Join us and our growing community at www.northone.io |

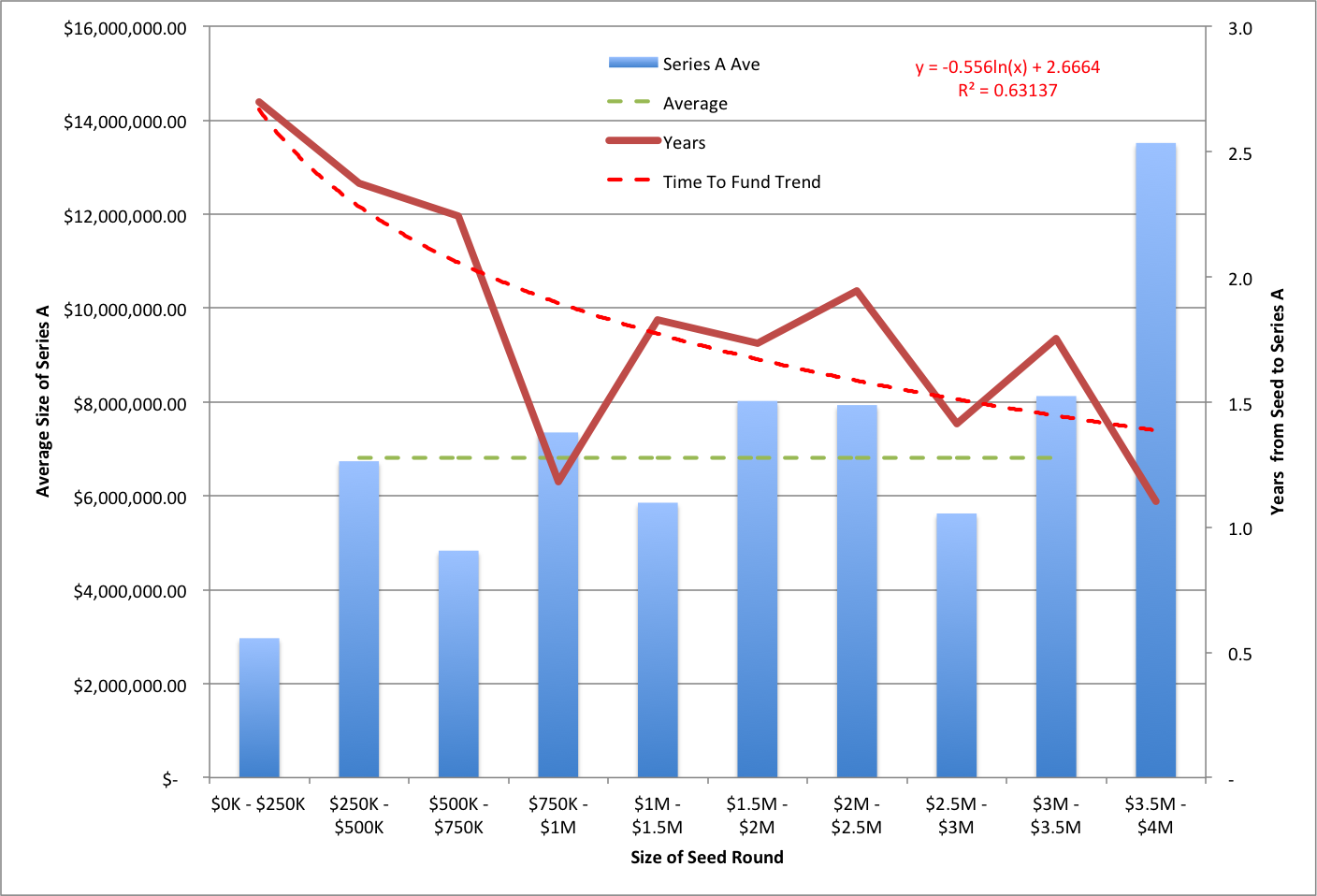

The bin groups are in $250k-seed groups below $1M Seed Round and $500k-seed groups over $1M investment. The blue bars are the average Series A raise for that bin group. The solid red line is the average number of years for each bin group to get a Series A. You can discover what you like from the graph, but here’s what I get out of it. Firstly, a Series A in Ontario for companies getting a Seed of $250K-$3.5M is on average about $7M (green dotted line). Secondly, the time from a Seed Round to a Series A event drops from around 2.7 years for a $250K seeded company to about 1 year for a $4M Seed Round (red dotted line). There are a couple of questions that come to mind, how can a company spend 2 years living off of $250K? These companies might already have offsetting revenue and they took less money because they needed less. How can a company get $4M in a Seed Round and then have to go back to the markets for a Series A of $13M? I can see a funder liking the scaling possibilities and putting these amounts into the second round.

The bin groups are in $250k-seed groups below $1M Seed Round and $500k-seed groups over $1M investment. The blue bars are the average Series A raise for that bin group. The solid red line is the average number of years for each bin group to get a Series A. You can discover what you like from the graph, but here’s what I get out of it. Firstly, a Series A in Ontario for companies getting a Seed of $250K-$3.5M is on average about $7M (green dotted line). Secondly, the time from a Seed Round to a Series A event drops from around 2.7 years for a $250K seeded company to about 1 year for a $4M Seed Round (red dotted line). There are a couple of questions that come to mind, how can a company spend 2 years living off of $250K? These companies might already have offsetting revenue and they took less money because they needed less. How can a company get $4M in a Seed Round and then have to go back to the markets for a Series A of $13M? I can see a funder liking the scaling possibilities and putting these amounts into the second round.