Hammond Paper is a provider of quality and custom paperboard, chipboard, cardboard for many uses such as liners, packaging, signage, board games, bookbinding, and furniture. David Campbell recently bought this “old economy” business from a retiring baby-boomer and he tells us how he did it and why. David Campbell is a 20-year veteran of the C-Suite. Ten months into his grand strategy to take over the World, we spoke to him over a steak sandwich with grilled mushrooms and peppers at a picnic table in Concord.

How did this deal shape out?

The Need

I’ve always wanted to do my own thing so I made the decision that I want to run and own my own business. The feedback I got from my close network was that a lot of baby boomers, people in their 60s and 70s who built businesses over the years are now looking to retire and they have no succession plans.

So I got out there and started talking to people.

The Math

Quickly looking at what was available, you should be able to buy an old economy business doing about 10% EBITDA margin at 2-4 EBITDA earnings multiple. Realistically you should probably be able to get vendor take-back of 30% of the purchase price, part of it you could finance with a BDC-like loan, and the rest you could risk your own capital. There were a lot of businesses in this cohort.

Looking at some of these companies, a lot of these business owners are in coast mode. And by coast mode, I mean very good in the day-to-day stuff but not doing any investments to grow and think of projects that have a timeline of longer than a year. And most of these companies do not do any sophisticated or structured marketing.

I had the view that I could grow the top line revenue by 50% over the course of three or four years and probably drop 30% of that to the bottom line (maybe even 50%) and if you can do that then the multiple looks even cheaper.

Plus, if you look hard there’s probably some immediate cost savings in some of these business activities. Using some rough numbers of $3-$5 million revenue range, and a 5% EBITDA margin means $250 thousand EBITDA. Let’s say the company is renting a lot of warehouse space and I’ve been able to sublet almost 15,000 square feet and the value of that is $150,000 a year. So now with one action, I have gone from $250 to $400 in EBITDA and I didn’t pay for it anywhere on my balance sheet. The money was just sitting there.

The Business

When I looked at these things I asked myself:

(1) do I like the industry?

I did not know the industry well, but I felt the eco-friendly nature of paper versus plastic was a long-term “good” factor. I also believed a disciplined marketing plan could be a growth driver because of the e-commerce factor I was going to introduce.

(2) do I like the people running the business?

I like the people, everyone I met seemed to be really grounded people. They were good at what they’ve been doing and they’ve been in that business for a while so I wasn’t concerned that I was going to buy a company and people would leave me standing around with no clue. I trust the guy who was selling the business and I knew a buddy of his we knew him well and vouch for his dependability and integrity and I knew he would stick around and teach me stuff as opposed to just taking my money and paying lip service to help me out over the next 6 months that was part of the deal. That’s part of a good deal – to find somebody who will stick around for a while.

(3) can I negotiate a Vendor Take Back?

I was able to get a vendor take-back for about 30% of the purchase price. This was an important part of the decision process.

(4) can I get bank and other financing?

I was able to get bank financing for about 50% of the purchase price and then I found 20% of my own money to put in the deal as cash on day 1. From a finance perspective that works pretty well too. this kind of arrangement limits the amount of capital you put up at the front of a deal and increases your leverage when the deal grows, which helps drive the ROI significantly on the back end.

What’s a good profile of someone wanting to do this themselves?

(1) I think it’s somebody who is willing to work hard at it. I did put in long hours – on average 12 hour days to get my head around the business and do all the daily stuff that the previous owner had been doing in 6 or 7 hours a day. He had the advantage of training himself to do it properly over 25 years. So energy and willingness to learn and work.

(2) You need some math and finance skills especially in this business which is very large and margin driven. It’s not an easy business because of the cost structures and the deal-to-deal makeup of a sale. Most of the time it’s one-off deals. So your negotiating skills need to be informed by the numbers.

(3) The ability to work with people. If I had difficulty speaking with people on my new team and they decided to leave I could not have taken over this business.

(4) Lastly, in my opinion, every CEO should be able to sell. You can’t come into this kind of relationship and believe you can sit at your desk and the company’s going to run itself. You have to know who your customer is, you have to be able to approach them, and you have to sell them the deal so that you will make money. You’re not just selling something to a customer; you’re convincing suppliers to give you credit or to lower the price of something, or you’re talking to a partner to give you a break on some idea or help you with the project, or you have to convince your staff that you’re going to come on board and they’re going to benefit from you coming on board.

To this last point, what did you do to give the team a feeling of confidence when you came on board?

The first thing I did was to have a town hall meeting and lunches with key individuals and I wanted to make sure that everybody knew what I wanted to accomplish. This town hall meeting was actually refreshing for the staff and they gave me a chance when I bought the company. There were some key people in there who I thought were underpaid relative to what they were doing especially since they were key to running important components of the business (components the original owner could manage himself but I didn’t understand well and were a risk for me), so one of the first things I did was adjust some salaries to reflect the work these key people were doing.

Do you have your own transition plan? Where are you going?

I bought this business with the intention of making it five times what it is today over the course of the next five or ten years. I’ve done a lot of things and I like being a business operator. I like getting my hands dirty and I’d rather do that than being a consultant off to the side. I like being the owner and the driver rather than one employee of many.

I have no intention of selling it. If it’s successful I’d look at handing it over to my kids, but I still have a ton of ideas I want to do with the business and I want to experiment with the best ones. This could include acquisitions and roll-ups. I said to myself don’t make any big moves in the first year, get to know the business and the industry. Even though I want to do big stuff I’m not ready yet. There is a lot of tactical stuff and day-to-day stuff that I’m still trying to just do really well. I should have a more refined strategic plan by the end of this year.

Have there been any hiccups along the way?

I’ve over bid on certain RFPs and day to day quotes and lost them, and underbid on certain deals and won them – sometimes giving up a whack of margin versus what the original owner would have done so there’s been a learning curve there for these one-off deals. It hurts the revenue and margins on both sides of the equation but that’s part of the learning process. But I did hire a new sales guy within 3 weeks of buying the business and beefed up our sales capabilities in other ways, and we are driving new revenues.

What software, processes or data capture are you doing?

I wasn’t sure what the key metrics were, so we started monitoring some key values such as new customers, return customers, revenue per customer, gross margins.

We issued a corporate handbook with company policies from “Soup To Nuts”, including harassment policy and vacation clauses. It all just flowed out of standard operating practices but there was nothing in writing earlier and it helps people understand that we were going to follow the same rules for everybody. This helped us shape accountability as well.

We introduced quote tracking so that we have a history of what we won and lost and to understand what the market rates are. You can go back and do the analysis and see which ones you’re winning and which ones you’re not.

We also picked a CRM system called “insightly” (we’re a small company and I’m not a sophisticated guy) and we are using this for prospect tracking. We use MailChimp as an email platform to reach our customers.

Currently, we are writing a quality manual, just around processes and procedures for optimal efficiency and quality of the production side. I’m working with the plant manager and the office manager on that manual.

Do you think an increase in the federal lending rate will limit this kind of activity in the future?

There are a lot of people operating in old economy businesses, that have no overhead, and one-point in interest rates won’t make or break their business. A key point is keeping your overheads down. And if your competitor has been running the business for 20 years and he’s paid off his equipment and building and you are paying your debt service on payout and equipment, that’s tough.

Old economy businesses are pretty competitive. So when I did my financing, I locked in a rate for 5 years. I didn’t want the risk of having rates go up a lot with a floating rate. I might have paid 2% more over this time. My guess was that interest rates will be going up and that helped me sleep at night.

Did you ever think of taking on a partner?

Yes. I have had constant discussions with various people I know and trust I want to bring in somebody else. I like the simplicity of being the sole owner, but I also believe other people with skin in the game and insights help the business run. Give them a vested interest in the success. That being said, I’ve raised a lot of money for various companies and having the right partner is critical – you need to be aligned in your vision of what you want the company to be and I think most importantly that you need to have the same risk profile. If I want to swing for the fences, but my partner wants to play it safe and grow at 3% per year, there’s going to be conflict and it won’t be worth it.

Creating a board of advisors of like-minded owners who could help me manage from the point of view of similar businesses is another idea. Twice a year you show up and present your business and ask others for input. If I don’t get someone as an equity investor I may go down that path.

Do you know what you don’t know?

I’ve been around and helped start and grow a number of small businesses so I have a good perspective on most areas of business, but there’s two areas that are really not my area of expertese:

(1) Manufacturing. I’ve not moved in this world at all and Idon’t know a whole bunch of stuff in this area, and

(2) Marketing. I know about the magic digital marketing can do, and I know what is possible, but I need a lot of help with these campaigns. I haven’t got around to completing my bigger marketing plan. Branding is another component I need help with. We should be branding our company and our products and services for the long term.

In both these areas, I am speaking to people who can be part of our team to own these areas of the business.

Last words?

I lucked out with a really great owner who transitioned to me over a 6-month period and is still available when I have a problem or can’t figure something out. I think the fact that he succeeds when I do, puts him in my corner also. The last word would be: surround yourself with bright, energetic people and create a structure for them to benefit from your success.

About the book’s Author: Jason Calacanis is the man behind the Launch Incubator and one of the most interesting and well-attended demo days in San Francisco. He is easily one of the top 10 most-active angel investors in Silicon Valley. He is also one of the most successful. He wasn’t born rich but worked to get where he is. This book is a gift to all of you who want something similar.

About the book’s Author: Jason Calacanis is the man behind the Launch Incubator and one of the most interesting and well-attended demo days in San Francisco. He is easily one of the top 10 most-active angel investors in Silicon Valley. He is also one of the most successful. He wasn’t born rich but worked to get where he is. This book is a gift to all of you who want something similar.

Pam Banks, the head of the Mississauga

Pam Banks, the head of the Mississauga

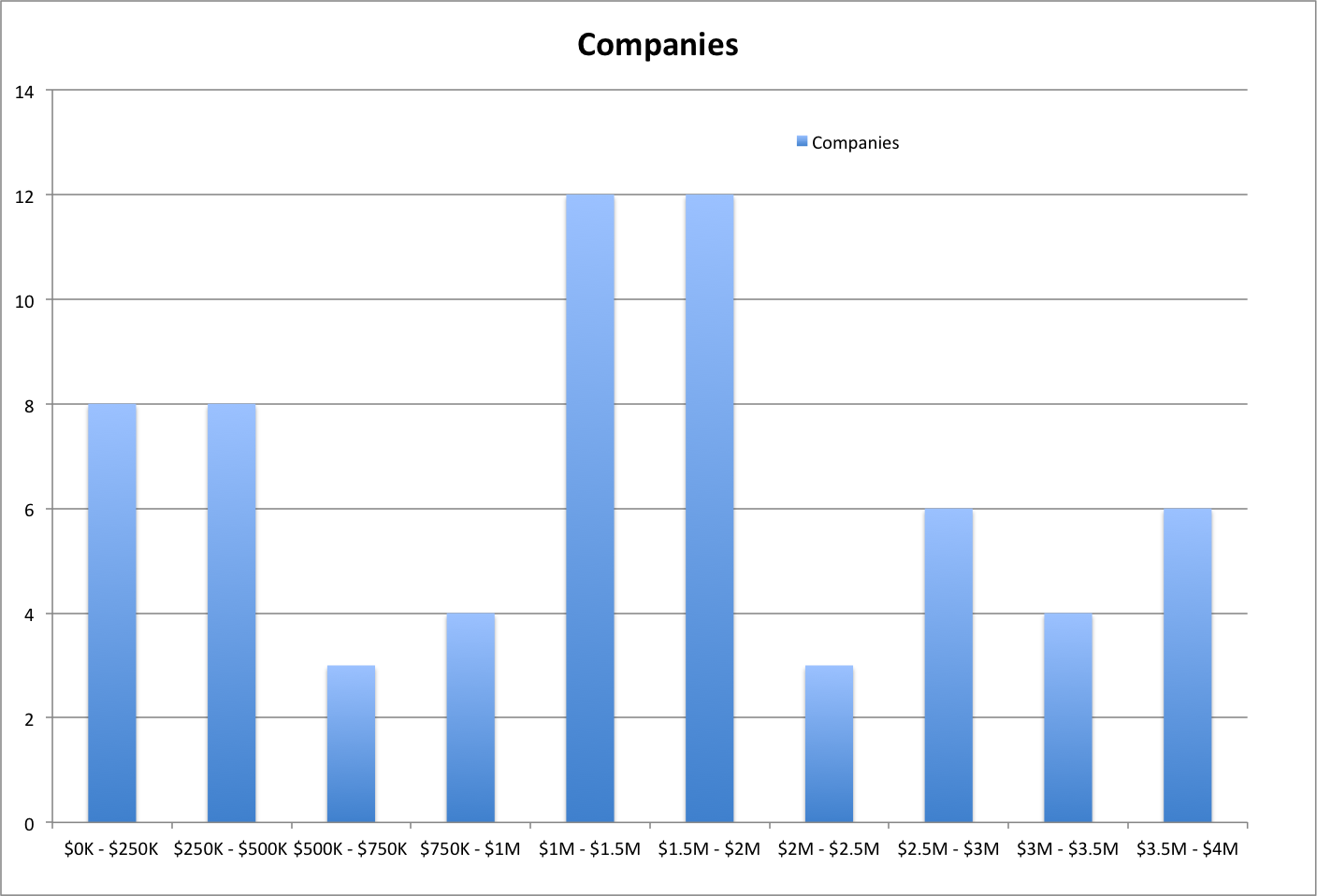

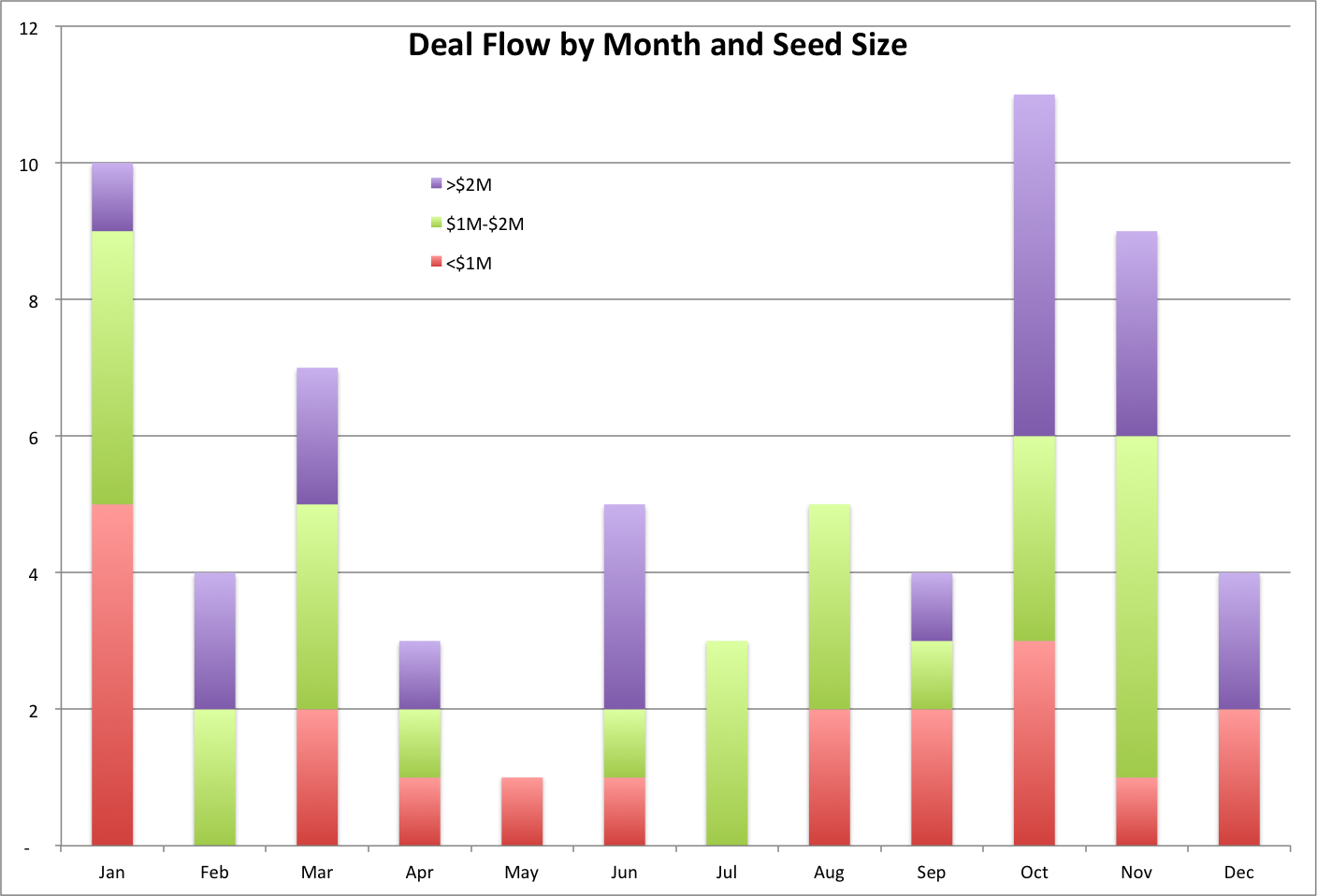

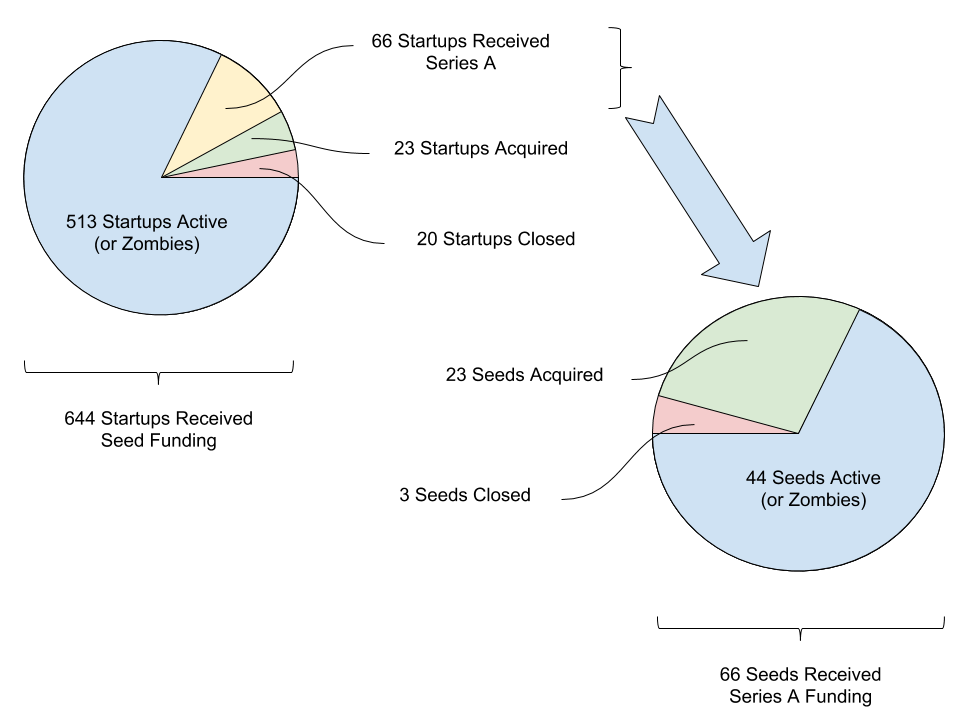

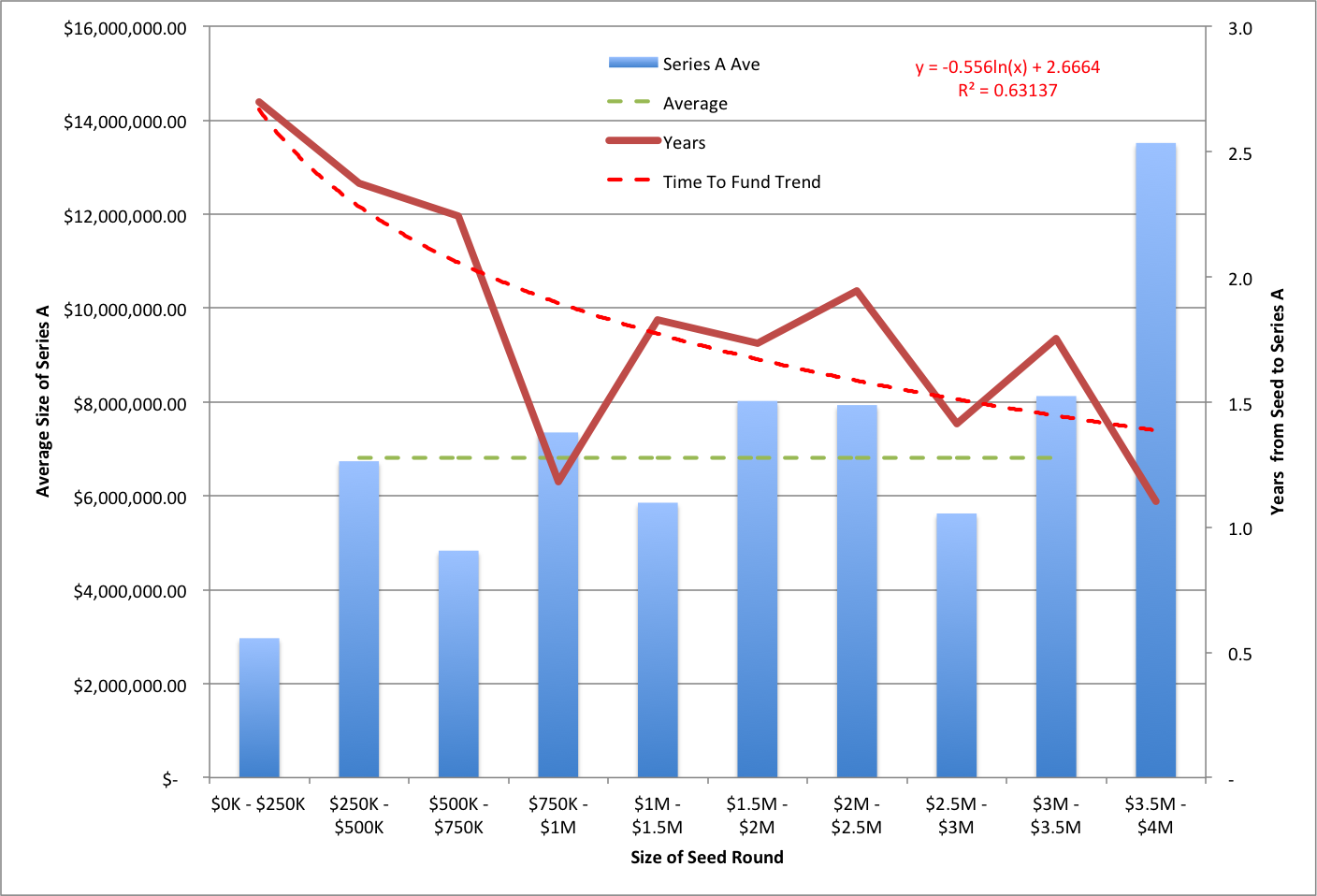

The bin groups are in $250k-seed groups below $1M Seed Round and $500k-seed groups over $1M investment. The blue bars are the average Series A raise for that bin group. The solid red line is the average number of years for each bin group to get a Series A. You can discover what you like from the graph, but here’s what I get out of it. Firstly, a Series A in Ontario for companies getting a Seed of $250K-$3.5M is on average about $7M (green dotted line). Secondly, the time from a Seed Round to a Series A event drops from around 2.7 years for a $250K seeded company to about 1 year for a $4M Seed Round (red dotted line). There are a couple of questions that come to mind, how can a company spend 2 years living off of $250K? These companies might already have offsetting revenue and they took less money because they needed less. How can a company get $4M in a Seed Round and then have to go back to the markets for a Series A of $13M? I can see a funder liking the scaling possibilities and putting these amounts into the second round.

The bin groups are in $250k-seed groups below $1M Seed Round and $500k-seed groups over $1M investment. The blue bars are the average Series A raise for that bin group. The solid red line is the average number of years for each bin group to get a Series A. You can discover what you like from the graph, but here’s what I get out of it. Firstly, a Series A in Ontario for companies getting a Seed of $250K-$3.5M is on average about $7M (green dotted line). Secondly, the time from a Seed Round to a Series A event drops from around 2.7 years for a $250K seeded company to about 1 year for a $4M Seed Round (red dotted line). There are a couple of questions that come to mind, how can a company spend 2 years living off of $250K? These companies might already have offsetting revenue and they took less money because they needed less. How can a company get $4M in a Seed Round and then have to go back to the markets for a Series A of $13M? I can see a funder liking the scaling possibilities and putting these amounts into the second round.